The maxbootR package provides fast and

consistent bootstrap methods for block maxima, designed for

applications in extreme value statistics. Under the hood,

performance-critical parts are implemented in C++ via Rcpp, enabling

efficient computation even for long time series.

These methods are based on the first consistent bootstrap approach for block maxima as introduced in Bücher & Staud (2024+): Bootstrapping Estimators based on the Block Maxima Method..

You can install the development version of maxbootR from

GitHub with:

# install.packages("devtools")

devtools::install_github("torbenstaud/maxbootR")or from the official CRAN repository in R with:

install.packages("maxbootR")The following example demonstrates how to extract sliding block maxima from synthetic data.

library(ggplot2)

library(maxbootR)

library(dplyr)

# Generate 100 years of daily observations

set.seed(91)

x <- rnorm(100 * 365)

# Extract sliding block maxima with 1-year window

bms <- blockmax(xx = x, block_size = 365, type = "sb")

# Create time-indexed tibble for plotting

df <- tibble(

day = seq.Date(from = as.Date("1900-01-01"), by = "1 day", length.out = length(bms)),

block_max = bms

)

# Plot the block maxima time series

ggplot(df, aes(x = day, y = block_max)) +

geom_line(color = "steelblue") +

labs(

title = "Sliding Block Maxima from Simulated Data",

x = "Year",

y = "Block Maximum"

)

Time series of block maxima from simulated normal data

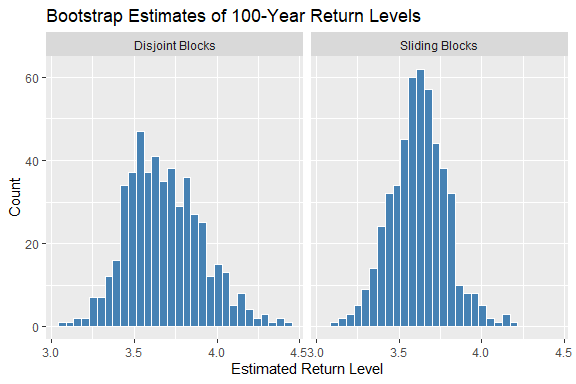

We now use the maxbootr() function to bootstrap the

100-year return level of synthetic data, comparing the

disjoint vs. sliding block bootstrap methods.

# Set block size (e.g., summer days)

bsize <- 92

# Generate synthetic time series

set.seed(1)

y <- rnorm(100 * bsize)

# Bootstrap using disjoint blocks (+timing)

system.time(

bst.db <- maxbootr(xx = y, est = "rl", block_size = bsize, B = 500,

type ="db", annuity = 100)

)

#> User System verstrichen

#> 0.61 0.00 0.69

# Bootstrap using sliding blocks (+timing)

system.time(

bst.sb <- maxbootr(xx = y, est = "rl", block_size = bsize, B = 500,

type = "sb", annuity = 100)

)

#> User System verstrichen

#> 6.86 0.00 6.89

# Compare variance

var(bst.sb) / var(bst.db)

#> [,1]

#> [1,] 0.5502442The sliding block method typically results in narrower bootstrap distributions, reducing statistical uncertainty.

Histogram of return level bootstrap replicates

For a full tutorial with real-world case studies (finance & climate), check out the vignette included in the package.

The implemented disjoint and sliding block bootstrap methods are grounded in the following foundational works:

The block bootstrap methodology itself is based on:

I plan to further enhance maxbootR by:

Your ideas and contributions are welcome — feel free to open an issue or pull request on GitHub!